We will begin first with what is last. The word “portfolio” derives from the Italian portafoglio. In 1719, this word described a type of briefcase specifically created to carry (porta) loose sheets of paper.

The word folio appears in many Romance languages. Italian. Spanish. French. English. Derived from the Latin term for “leaf,” the Gutenberg Bible and the definitive printing of Shakespeare’s works, known as the First Folio published in 1623, were printed in a “folio” format. These books were important collections of various writings. Eventually, the term folio came to represent more the assemblage of material than the “sheet of paper” it had originally indicated.

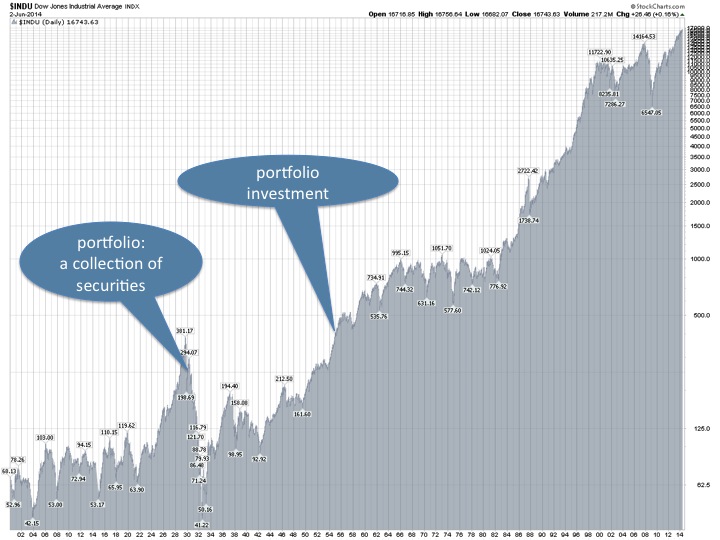

Interestingly, it was not until after Black Tuesday and the Great Stock Market Crash of October 29, 1929 that the word in English came to mean “a collection of securities held.” Curiously, the compound noun “portfolio investment” would not enter the lexicon until 1955, a full year after the American stock market, as measured by the Dow Jones Industrial Average, fully recovered from the Great Depression and finally exceeded its high of 381.17 set on August 26, 1929. This period of 25 years represents the longest business cycle in the modern history of the United States.

For the purposes of this website, portfolio means “a complete collection of financial assets.” We use this definition because all too often the word “portfolio” is equated with “account.” However, your “portfolio” does not just encompass the securities you may hold in a retirement or other brokerage account. A portfolio includes all the financial assets you hold: savings and checking accounts, life insurance policies, debt, real estate, employment, business interests, pensions, as well as all brokerage accounts tax-advantaged or otherwise. A portfolio is all-inclusive and is only limited in scope by the person or persons who are invested in it.

[follow_me]