Hypothesis:

Warren Buffett’s Berkshire Hathaway (BRK.B) and Brazilian private equity firm 3G Capital will team up yet again to buy The Coca-Cola Co. (KO) within the next 18 months.

Introduction

I am going to make a bold statement. You can choose to agree with me or not. The motivation for me publishing this post is mostly to get feedback on this investment idea that has dogged me for the past month or so. Berkshire Hathaway and 3G Capital have cozied up on three mega-deals now. The magnitude of these deals are increasing, and I just can’t shake the feeling that I just may be onto something here. What’s next for this burgeoning successful partnership of heavy-hitting investors?

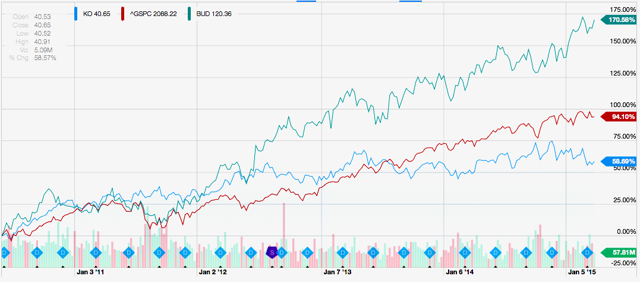

Buffett continues to be criticized for his large equity stake in Coke, which has lagged the S&P for 5 years. Has he just lost his touch? Not at all. But still… He must be wondering how he could shake up his favorite company.

The post provides a valuation of “core Coke” approximated from recent SEC filings that highlights not only the excessive bloat that The Coca Cola Co. has on its balance sheet but also the incredible operating margins present in its syrups-and-concentrates wheelhouse. Finally, this post examines a potential structure of what would be one of the largest M&A deals in the history of Wall Street.

So grab a Coke and let’s get started. This post is gonna be a long one.

Other pundits, as outlined by this January article in the Wall Street Journal and more recently by Forbes, have been speculating this year on a potential 3G mega-merger since the start of the year. Names recently bandied about have been Campbell Soup Company (CPB), Kellogg Company (K), PepsiCo Inc. (PEP), and SABMiller plc (SBMRY). What do these companies all have in common with the proposed $45 billion Berkshire/3G creation of the Kraft Heinz Company?

They are all low-beta stocks with substantial dividends and significant international exposure. Conspicuously absent from the most recent rumormongering is, in my opinion, the most obvious acquisition choice: The Coca-Cola Company.

Though M&A rumors have simmered down a bit while the ever-acquisitive Brazilians digest their macaroni and cheese, a Buffett/3G acquisition of The Coca-Cola Co. is by no means beyond the scope of this burgeoning investment partnership, despite Coke’s enormous market cap. I firmly believe that the recent salad-dressing-and-ketchup pairing is just an appetizer to these two voracious predators. After all, Mr. Buffett has many times recently been quoted that he is on the hunt for “elephants”. Bolt-on acquisitions by Berkshire subsidiaries and savvy stock picking has clearly been left to his successors as preparation for their expanded roles once he finally passes the reins of his beloved company on to the next generation.

Warren Buffett himself is on safari.

The Coca-Cola Co. is a mighty big elephant.

Being that a Coke takeover would be amongst the largest acquisitions ever, a review of the facts before delving into the mechanics of such a potential deal is in order.

Facts:

1. Berkshire owns 400 million shares of The Coca-Cola Co., which represents approximately 9% of the outstanding shares in the currently $180 billion company. The stake is roughly valued at $16 billion. Analysts persistently question Buffett’s logic behind maintaining 15% of Berkshire Hathaway’s investment portfolio in this slow-moving dinosaur of a stock. However, Berkshire absolutely cannot sell this stake. The reason? The cost basis for this asset is around $1.3 billion, or around $3.25 per current share. Today, The Coca-Cola Co. pays a $1.32 dividend per share for a current yield-on-cost for Berkshire Hathaway of 40.6%. Even considering the impact of taxes on the dividends, this investment pays for itself over and over again every 3.78 years. As the dividend inexorably grows, this timeframe will shorten. Moreover, should the conglomerate sell its stake at today’s prices, it would face a tax bill of a little over $5.2 billion. Not to mention losing $528 million per year of positive cash flow! Buffett’s purchases of Coke stock, amassed at various opportune times between 1988 and 1993, is truly one of the greatest investments of all-time.

2. The founders of 3G Capital and their co-investors, via Stichting Anheuser-Busch InBev, currently control 52.16% of suds behemoth AB InBev (BUD), currently a $192 billion company. In fact, the story of Jorge Paulo Lemann and his associates persistently building up their investment in a sleepy old Brazilian brewer into a multinational beverage conglomerate with 25% global market share is an even more remarkable investment story than Buffet’s long relationship with The Coca-Cola Co. The usual methods with which Berkshire Hathaway and 3G approach their investments could not be more different. Whereas Berkshire takes passive stakes and largely remains on the sidelines, 3G relentlessly pursues synergies and bigger prey. As a result, their active style typically offers a scintillatingly higher return on investment, albeit with substantially more risk. Since their 1989 purchase of Brahma, the secretive group of investors behind 3G Capital has turned $20 million of seed capital into a stake worth approximately $100 billion. This multi-decade odyssey has rightfully earned them the title of “the best operators in the world” that both Bill Ackman, an activist investor that partnered with 3G on their Burger King investment, and Buffett have bestowed upon them.

3. The amount of cash and short-term investments of the respective companies that could be involved in this mega-deal, as of the end of 1Q 2015, are as follows. First, the publicly listed companies:

- Berkshire Hathaway: $63.7 billion

- The Coca-Cola Co.: $20.5 billion (includes marketable securities)

- Anheuser-Busch InBev: $8.7 billion (end of 2014)

Privately held 3G Capital is the wild card. With 52% of AB InBev, 51% of Burger King Tim Hortons a.k.a. Restaurant Brands International (QSR), and a soon-to-be 49% stake in Kraft-Heinz (KRFT), they would seem to have plenty of equity to access the capital markets just on the basis of these combined dividend streams alone. As three independently wealthy individuals, the three founders have a combined net worth estimated at more than $40 billion. As a private equity fund, they also have the ability to raise funds from investors. Contributing $5 billion in cash to the Kraft acquisition seemed to present no problem to 3G. Unlike other private equity firms, 3G Capital approaches the same “roughly three dozen of the world’s wealthiest families and individuals” over and over again. So far, investors have had nothing but astounding success.

4. The Coca-Cola Company has other valuable assets outside of its concentrates-and-syrups core business. Why is this important? In the same way that 3G sold off Anheuser-Busch’s theme parks business for $2.7 billion to Blackstone after that hostile $52 billion takeover in 2008, 3G can again undertake the sale of non-core assets to lower the overall cost of acquisition.

Determining a Value for “Core Coke”

When I mention this idea to my colleagues over beer, the first reaction usually has to do with the sheer size of the acquisition target.

“There’s no way Buffett can take out a $180 billion company!”

However, the part of The Coca-Cola Co. that most intrigues value investors like 3G and Berkshire Hathaway is its ability to sell sugar water at absurdly high margins at prices that are virtually guaranteed to outpace inflation. Although such a headline-grabbing takeover would certainly cost over $200 billion at the outset, by the time this world-class combination of cold-hearted operators and shrewd dealmakers is done with KO their total invested capital is likely to be well below that outsized figure.

First, The Coca-Cola Co. owns shares in up-and-coming beverage competitors that are held on the balance sheet as available-for-sale securities. These investments primarily include debt securities, a 16% interest in Keurig Green Mountain Inc. (GMCR), and a 16.7% stake in Monster Beverage Corp. (MNST). At the end of 1Q 2015, these available-for-sale assets were carried on the balance sheet at a value of $7.986 billion. Depending on 3G’s vision for future Coke, these assets could easily be liquidated as a means to reduce debt.

In addition, the Coca-Cola Co. has a portfolio of minority stakes in international bottlers that is carried on the balance sheet using the equity method. Without delving into an accounting lecture, using the equity method means that the investment is carried on the balance sheet at original cost rather than fair value, despite the fact that these bottlers have liquid markets for their equity securities. According to the April 2015 10-Q, these investments have a current fair value of $10.76 billion. This market valuation is nearly $5.6 billion more than the carrying value of these assets, which is currently $5.187 billion.

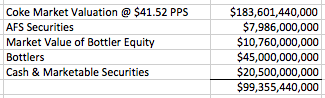

For the purposes of this exercise, I assign the extant majority-owned bottling operations a value of approximately $45 billion (see next section). Given the valuation of these assets, we can clearly see that The Coca-Cola Co. is not nearly as big as its market cap makes it seem. Here is my value of “core Coke”:

Thus, Coke may look like an elephant too big to kill, but it is really only about a $100 billion company, or a little less than three-fifths of the size that it looks like upon initial glance. Especially with a little help from his Brazilian pals, I think Warren can hunt this company no problem.

The key to this transaction will be the combined ability of Berkshire Hathaway and 3G Capital to lever up. Although this initial step could perhaps be expensive, should the partnership just decide to retain “core Coke”, the impact to the permanent capital of these two firms would actually be quite manageable. After all, what are 12,631,531 shares, equivalent to 2.92%, of Goldman Sachs (GS) worth anyway if it can’t even get you favorable financing terms on a whole heap of commercial paper?

A Bottling Odyssey

Before I delve into the complex mechanics of this potential deal, interested investors need to understand the bifurcated nature of Coke’s business. The Coca Cola Co. is really two major businesses. On the one hand, it is a high-margin purveyor of sugar-based mixtures to sell to restaurants and bottlers. On the other hand, it is an extremely low-margin distributor and manufacturer of water-based beverages that pays a high price to its doppelganger business unit for the right to use its proprietary syrups and concentrates.

The bipolar nature of the business has plagued Coke management for more than three decades. Thus, the biggest piece of hidden value or, depending on your perspective, the source of subpar margin performance at The Coca-Cola Co. is its collection of bottling assets that still reside on its balance sheet. The company has a long and strange history with its bottlers, constantly divesting and reacquiring them according to the financial engineering whims of whatever CEO is at the helm.

The process began in 1980 when then-CEO Robert Goizueta announced a plan to refranchise bottling operations, buying up poorly performing operations, recapitalizing them, making them more efficient, and then reselling them to larger better-run operations like Coca-Cola Enterprises (CCE). The process continued for more than two decades, with the gains on sale from each flip of bottler assets significantly juicing earnings for that quarter. A Harvard Business School case study quotes then-president Donald Keough as characterizing the company as “an investment banking firm specializing in bottler deals” during this period.

Most recently, current CEO Muhtar Kent, apparently for lack of any better ideas or perhaps just to emulate his predecessors, swapped their European bottling operations for their North American ones with bottling franchisee CCE in 2010. This transaction at the time was valued at $12.3 billion and brought the percentage of in-house bottlers up from 20% to 28% of global sales volume. Now we know that KO is in the midst of refranchising these operations to unconsolidated partners, but it is hard to determine a specific market value for the still-held bottling assets. The most recent 10-Q states the following:

The Bottling Investments operating segment includes all Company-owned or consolidated bottling operations, regardless of geographic location, except for bottling operations managed by Coca-Cola Refreshments (“CCR”), which are included in our North America operating segment.

Currently, according to Note 15 of the most recent quarterly report, Bottling Investments lists $6.9 billion in identifiable operating assets and $8.7 billion in noncurrent investments, for a total of $15.6 billion in assets. In turn, North America lists $33.5 billion of identifiable operating assets, not all of which are likely to be dedicated to finished goods manufacturing.

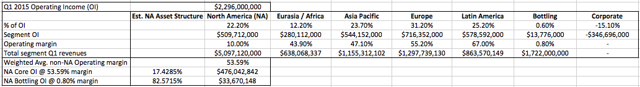

However, given the capital-intensive nature of the bottling business, we can assume that most assets are dedicated to bottling. In my valuation of this segment of the business, operating income I have assumed that 82.6% of the assets in the North American operating segment are dedicated to the North American bottling and distribution business. By analyzing the regional operating income and operating margin tables provided on page 38 of the most recent 10-Q, I am confident in this categorization of the North American assets. In order for the North American segment to display such woeful margins compared to other international regions, low-margin bottling and distribution revenue must make up a large part of the revenue base.

Hence, there are a few methods to value the bottling and distribution business. First, by summing the book values of all the operating assets and noncurrent investments, while applying the 82.6% figure to the North American assets, the book value alone is worth $43.27 billion. My calculation of “core Coke” above rounded this up to $45 billion, a more than reasonable slight premium to book.

Another method is to apply the multiple used in the $12.3 billion deal with CCE in 2010 to the entire current portfolio of assets. If gobbling up 8% of the global sales volume was worth that much money five years ago, we can assume that the bottlers that KO currently operates that manage 28% of global sales volume are currently worth at least $42.7 billion.

In addition to unlocking substantial value for a potential acquirer, the monetization of bottler assets would also massively reduce required capital expenditures going forward. Note that in the most recent 10-K, Coca Cola expects “2015 full year capital expenditures to be approximately $2.5 billion to $3.0 billion, primarily in our Bottling Investments operating segment and our finished product operations in our North America operating segment.”

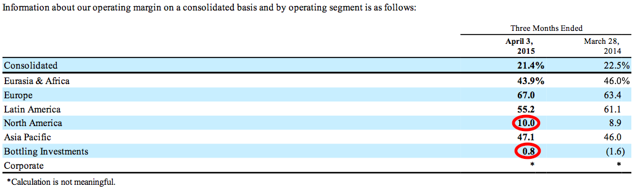

This considerable capex in combination with the extremely low margins of those investments underscores the desperate need for The Coca-Cola Co. to efficiently divest itself of its bottling business. Here is the aforementioned segmented operating margin table from the most recent quarter. The outliers are circled in red:

Without the capital-intensive bottling assets weighing down profitability, The Coca Cola Co. would have a stunning operating margin of 48.2% instead of its currently merely respectable operating margin of 21.4%. For context, the holy grail of operating margins has long been found in technology companies. Today, Facebook (FB) holds the “king of operating margins” crown with a gravity-defying 35.83% according to Yahoo Finance.

Core Coke’s operating margins trounce that figure.

Imagine the valuation of “core Coke” if investors could evaluate it without the weight of its manufacturing side. Currently, the forward price-to-earnings ratio of KO is a pedantic 19.5 but the company’s core clearly deserves a much higher multiple. Such price-to-earnings multiple expansion would largely compensate the acquirers for the hefty takeout premium that they would most likely have to tender to get this acquisition done.

Brazil’s 3G Loves American Traditions

Budweiser. Burger King. Heinz. Kraft. Do you begin to see a pattern here? 3G is after iconic American brands. Why? They have significant pricing power in international expansion. Moreover, long-standing American firms such as these often have significant corporate excess from years of promotions from within, hiring liberally from alma maters, and overlapping responsibilities in the executive suite.

The Coca-Cola Co. is no different. In fact, being arguably the most American of American icons and with its roots firmly in Southern “good old boy” culture, KO may even be the worst offender of all among these firms. If indeed true, this criticism would certainly go a long way in explaining the stock having languished for years.

An example of this excess happened last year in the investor tumult over a proposed $13 billion executive compensation scheme, which both Buffett and activist investor David Winters termed “excessive”. That same Business Insider article linked to above claims that the plan would have affected 6,500 managers.

Wait. Sixty-five hundred managers? No wonder Winters’ Wintergreen Asset Management and Japanese firm Nomura Holdings have previously called for 3G to take the reins. I doubt there are 6,500 managers total across all of AB InBev, Restaurant Brands International Inc. , and Heinz combined.

The Coca-Cola Co. is exactly the kind of company that 3G Capital thrives on: burdened by its legacy, desperately in need of new blood to bring a truly new vision that is not just a rehash of the same work of executives past, a management team without any preconceptions or sacred cows that is ready and willing to cut the fat from the executive horde, not just in a piecemeal fashion, but a true corporate bloodletting. That is the 3G way. As the New York Times described it: “Take ownership of iconic brands, aggressively cut costs and expand internationally.”

As a shareholder, you certainly cannot argue with the results:

While KO has lagged the S&P 500 by more than 35% in total return over the past five years, AB InBev has trounced the benchmark by 76.48% in total return.

:format(jpeg):mode_rgb()/discogs-images/R-2844895-1320983142.jpeg.jpg)

Have a Coke and a Smile

Despite Warren Buffett’s friendly appearance at the Coca-Cola annual meetings a few weeks ago, there is no way he would refuse a means to better monetize his stake in The Coca-Cola Co. His recent tax-free equity-for-assets swaps with Procter & Gamble Co. (PG) and Graham Holdings Co. (GHC) prove that the old Oracle does not intend on ever paying a tax that he does not have to, political inclinations and grandiose statements be damned.

Therefore, Buffett would never liquidate his position in Coke stock and subject his shareholders to a permanent loss of both $5 billion of equity and a $500 million-plus perpetuity. Instead, I predict that Berkshire Hathaway will contribute an additional $15 billion or so of permanent equity as well as a healthy smattering of convertible 9% preferred shares to a 3G takeover of The Coca-Cola Co. Such an investment would boost the current stake from around 9% today to somewhere in the 25-30% range. With 3G as operators, as well as equity partners, the annual dividends on such an equity position should quickly surpass $2 billion.

The Kraft-Heinz and BK-Tim Hortons mergers prove that Berkshire Hathaway is not necessarily trying to wholly acquire companies on the scale of BNSF. Remember that Buffett is elephant hunting. And these ever-larger deals that leave gargantuan dividend-spewing positions on the balance sheet are a fantastic way to leave a legacy. When it’s all said and done, Bank of America (BAC) and Kraft-Heinz will become top-five positions in the vaunted Berkshire stock portfolio. In my opinion, Coke will become the top position before the end of 2016.

Keep in mind that the $45 billion Kraft-Heinz deal only required the contribution of the H.J. Heinz Co., which had been mutually acquired in 2013 for $23.2 billion, and an additional $10 billion in cash. That $11.8 billion gap in valuation represents 26.2% of the total. Where did this tremendous increase in value come from in just a little less than 2 years? That would be the now familiar 3G “recipe” described above. Remember that their goal is not to take over the entire company but to retain only a slight majority with their partners.

In a potentially hostile deal for Coke, 3G would have to line up some bridge financing with some major investment banks. However, this hurdle hardly seems worth mentioning given Berkshire Hathaway as a partner and the fact that AB InBev has long been talking with financiers about taking over rival SAB Miller for $122 billion. Also, the takeover may even be welcomed by Coke’s current executives, especially if Warren and his son Howard, who sits on the board of directors at Coca-Cola, can deftly introduce the concept. Moreover, the current management is the same team of executives that tried to sneak a huge $13 billion payday for themselves by its shareholders just last year. A Berkshire/3G takeover would just be another means to the same end.

Wheeling and Dealing

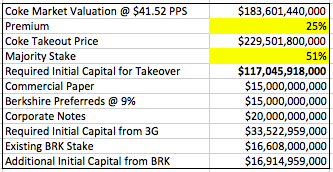

Let’s take a look at the initial capital necessary to get this deal rolling as well as the potential sources of funding for the initial transaction. Using the Heinz takeover and the Kraft-Heinz merger as models, both of which only required the contribution of cash slightly over the 50% threshold, the following figures assume that Berkshire/3G will initially take a 51% position in the paragon Southern soft drinks company and pay a 25% premium on the current KO stock price.

In the end, predicting the structure of deals this big is pure speculation. But it can be immensely fun for nerds like me.

Earlier I mentioned an article that noted that the 3G boys are rumored to have lined up $122 billion for their next AB InBev move. Each step in that journey to suds superstardom required significant support from investment banks along the way. To suggest that 3G Capital, with the backing of Berkshire Hathaway, cannot get together approximately $70 billion, is ludicrous. To take over a premium cash-printing machine like The Coca Cola Co., these funds can easily by obtained by the Brazilian rock star financier trio, either by levering up with investment banks or seeking to obtain private equity capital from its exclusive list of Wall Street luminary investors, a feat which many reporters have said has already begun.

For its part, Berkshire Hathaway would have to contribute approximately $32 billion in capital, split approximately equally between preferred shares and additional equity. Berkshire would also be contributing its current equity stake and backing the short-term debt of approximately $35 billion to get the deal done.

Accessing the commercial paper market should be fairly straightforward because the market itself is about to be in dire straits. With the General Electric Company (GE) exiting the finance industry by divesting itself of GE Capital, there will soon be a huge demand for high-quality short-term paper. Current estimates are that, as a result of this divestiture, “the direct CP [commercial paper] issuers market will shrink by $17 billion, or 23%, in the next eight months.” Although forthcoming regulations that mandate that money market funds hold only risk-free government debt will mitigate the impact of this grand exit, that’s an awful large hole in the CP market just waiting to be utilized by a highly-rated corporation to make some power moves.

Does anyone know a company that fits that profile? I do, and its CEO is out on safari.

Joining the flood of blue chip companies tapping today’s historically low interest rates to fund short-term financing needs with two to five-year corporate notes just makes sense. Moreover, with Berkshire and its AA and rising S&P credit rating involved in the transaction, the interest rates on that debt will likely be lower than that which could be obtained by Coke, which had Moody’s and Fitch lower their credit ratings on Coke last year. Interestingly, S&P recently put its AA rating on “negative outlook”, citing concern over its ability to increase cash flow in the near future as well as the company’s choice to make expensive strategic investments (Keurig and Monster) as opposed to reducing debt.

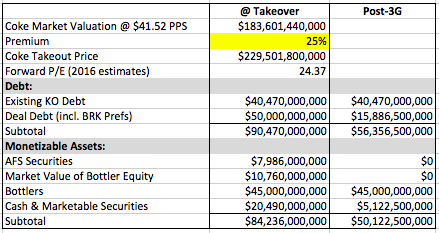

I wonder if the “best operators in the world” could maybe solve these two problems? Hmmmmm… Here is my suggestion for their first step as new owners to revamp the capital structure of Coca-Cola:

In short order, new management could reduce the leverage used to enact the deal by selling not only the stakes in the international bottlers, but also the debt securities, Monster, and Keurig stakes mentioned earlier. In the long run, I believe it is misguided for Coca-Cola to get too far astray from its high margin syrups-and-concentrates specialty. I think 3G will agree. But you could convince me otherwise. Maybe Warren Buffett really likes K-Cups.

No matter his stance on convenient coffee dispensers, what Buffett truly adores are preferred shares. I imagine that he will not mind at all receiving a 9% dividend on the preferreds used to facilitate this acquisition for as many years as 3G managers are comfortable with. Plus, the warrants likely attached to those shares would allow Berkshire to substantially boost its stake in Coke with cash flows that will be hitting the BRK balance sheet three to five years from now.

Furthermore, even after selling the securities mentioned above, the acquirers would still have their bottling assets, which could be sold on a longer-term horizon (2-3 years) in order to maximize their value.

At this point, I would imagine that AB InBev would get involved in the bidding for the bottling and distribution businesses. The Budweiser folks have long coveted Coke’s 25% global market share. Since the 3G acquisition in 2008, the overarching goal for the marketing team has been to make Bud the “Coke of Beers”, a beverage category where no brand has yet to exceed even a 5% global market share. More distribution would help in this goal. Eventually, Budweiser and Coke bottling and distribution, once combined and synergized in that special 3G way, could be spun off into a separate super-efficient goliath.

If the BUD team were concerned about weighing down their operating margins, another potential acquirer of the low-margin distribution business would be Berkshire’s own McLane unit. In 2003, the company was acquired from Wal-Mart, which divested the asset due to its “razor thin” margins. Although McLane operates mainly in the food (rather than beverage) distribution business, McLane’s annual revenues (now at $47 billion) have more than doubled since being acquired. Margins are not a concern for Berkshire’s wholly-owned subsidiaries, just that they provide stable, consistent, and predictable cash flows that can be regularly redirected to their most efficient use.

Proceeds from the monetization of the bottling assets could be used to reduce Coke’s corporate debt or, more likely, to fund a special dividend that would help 3G to defray its individual $34 billion investment at the time of the takeover. A special dividend would also provide Mr. Buffett with more ammunition for the elephant hunting that will come to define the final stages of his career.

The last step in getting Coke’s financial house in order should be old hat to 3G by now. Simply enact the same relentless cost-cutting measures that they implemented at their other acquisitions. In short order, Coke’s approximately $1.5 billion per quarter in free cash flow would substantially increase. Those new funds would likely be used to increase the dividend, primarily benefiting its two new largest shareholders: Berkshire Hathaway and 3G Capital.

And a leaner, meaner, more-focused Coca-Cola Co. would serve as an enduring American icon for another hundred years.

Conclusion

Hence, I recommend starting a position in The Coca-Cola Co. at today’s prices of around $41 per share. Berkshire and 3G are well capitalized and will be looking to escalate their immensely successful partnership soon. The Coca-Cola Co. is one of the few iconic American brands that could surpass their recent Kraft-Heinz coup.

At today’s price levels, even without considering this potential blockbuster deal, the company is currently attractively priced. From my own perspective, KO is a Beta Dog, which means it is one of the six lowest beta investments in the Dow. KO has a 5-year beta of 0.50 while yielding 3.2%. Beta Dogs are ideal retirement account investments because they generally offer quality yield with significantly lower risk profile than the market as a whole.

Additionally, because 80% of profits come from outside the United States, growth will eventually be restored to the stock. In the long run, the dollar will moderate and emerging markets will outperform the U.S. market. With proper adjustments by management, The Coca-Cola Co. could be a big mover for generations to come. The optionality of a potentially huge move like a Berkshire/3G acquisition takes the stock from a buy to a screaming buy.

Disclaimers:

This post is based on pure speculation. I have no inside information. I am just an observer, not a seer.

I have, however, owned stock in Berkshire Hathaway for nearly 10 years. Like many value investors, I have at one time or another faithfully read all of Berkshire CEO Warren Buffett’s annual shareholder letters. I have also read many of the excellent Buffett biographies published over the years, including Alice Schroeder’s intimate The Snowball: Warren Buffett and the Business of Life and Roger Lowenstein’s seminal Buffett: The Making of an American Capitalist.

I wrote this article myself, and it expresses my own opinions. My opinions are just that – opinions – and should not be regarded as specific actionable investment advice. Individual investors have individual needs and without comprehensive knowledge of an individual’s unique financial situation, I am afraid I cannot dispense any useful investment advice. I am not receiving compensation for this post and I have no business relationship with any company whose stock is mentioned in this article.

Outstanding.

I have been a brk/a and KO investor since 1989. This KO purchase is a smart move. But aren’t all our KO shares bought out when the deal is done. And no more dividends for us.

I wouldn’t say that that necessarily would be the case. Look how 3G has managed its stake in BUD, which is still publicly traded and currently pays a 3.6% dividend. Or how this tandem has announced it will handle Kraft Heinz (KHC), which is still publicly traded and should have a substantial and growing dividend for years to come. Were a purchase of KO to happen, I would imagine it would take the form of a tender offer where existing shareholders would have the choice to sell for a premium or hold for new management. Again, Berk/3G only really needs 51% of the shares to begin to effect some of the changes discussed in this post.